Episode: How to Account for Bitcoin

How to Account for Bitcoin

4/7/21

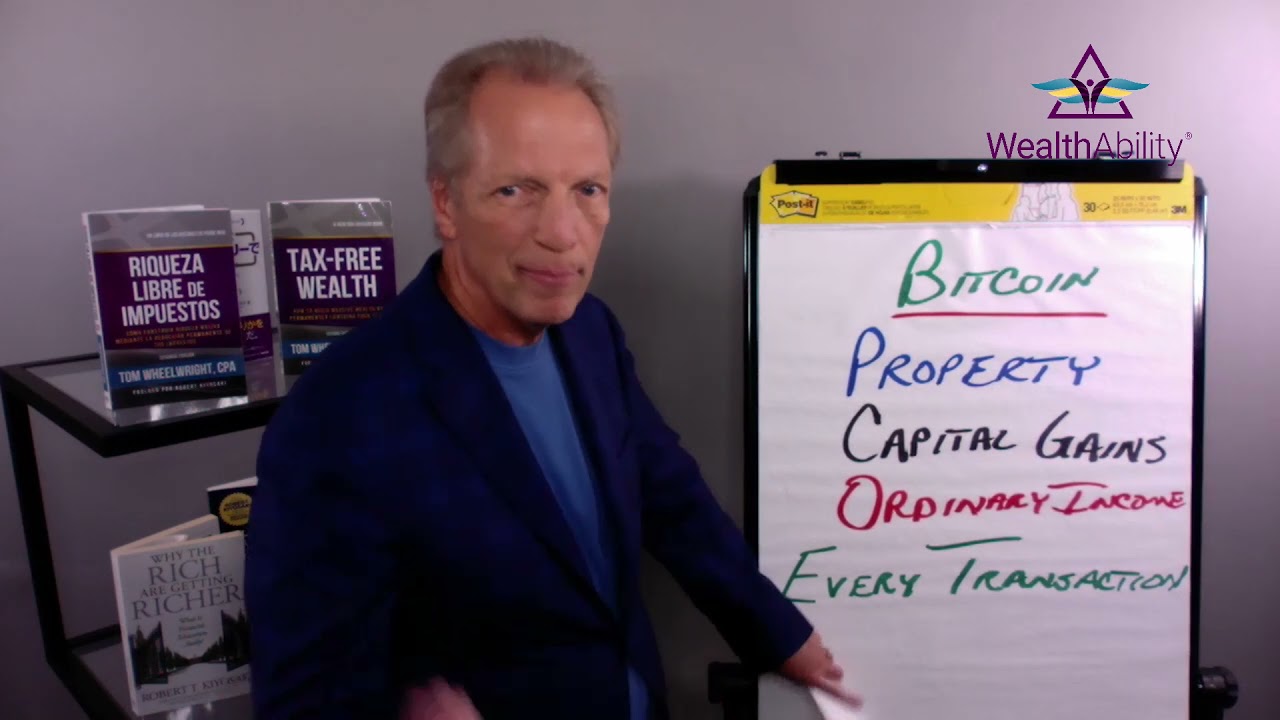

Cryptocurrencies look like they are here to stay. As financial advisors, it is becoming increasingly important that we educate ourselves on the functionality of cryptocurrencies like Bitcoin as our clients embrace them more and more. In this episode, Tom breaks down how the IRS views Bitcoin, the differences between cryptocurrencies, and the role we can play for our clients as these modern currencies become commonplace.

Episode Talking Points:

- 03:22 – How does the IRS view Bitcoin?

- 12:19 – Will Bitcoin be tracked by the government?

- 15:11 – Is it important to distinguish between cryptocurrencies?

- 19:53 – The role we play as advisors to our clients.

Recent Episodes

More From Tom

Weekly Report